The Cocktail That Drives ROAS

🥃 If you’re still choosing between macro or micro creators, you’re asking the wrong question, Amazon Just Pulled Out of Google Shopping Ads, And It’s a Big Deal and more!

Howdy Readers 🥰

In this newsletter, you’ll find:

🥃 Creator Mixology: The Cocktail That Drives ROAS

🚨 Amazon Just Pulled Out of Google Shopping Ads, And It’s a Big Deal

🚀 Tweet of the Day

If you’re new to Buyology then a hearty welcome to you, You’ve reached the right place alongside 50k+ amazing people, Before you forget, if someone forwarded this newsletter to you, don't forget to subscribe to our newsletter so you never miss out!

Together with Portless

📉 Delayed by Tariffs? Losing Margin on Inventory? You’re Not Alone

The recent tariff chaos crushed summer sales for brands that ran out of stock, or waited too long for relief.

And while tariffs are now lowered for 90 days, you still face 30% duties and 60–90 day delays. That’s not a winning formula.

Here’s what Portless unlocks instead:

⏱️ Ship directly from China to customers in just 6 days

📦 Restock best-sellers in under a week without stockouts

💵 Pay tariffs only after your customers check out

📊 Eliminate bulk inventory risks and reduce upfront capital

With Portless, brands unlock 3× better cash flow by reducing inventory drag, shortening lead times, and freeing up capital to reinvest in growth.

While others wait for containers, you’re already shipping, selling, and scaling.

📊Want to see if Portless works for your brand?

Book a free risk assessment and get a custom fulfillment cost reduction audit based on your inventory, SKUs, and timelines.

Book your free risk assessment today!

🥃 Creator Mixology: The Cocktail That Drives ROAS

If you’re still choosing between macro or micro creators, you’re asking the wrong question.

The highest-performing DTC brands don’t pick, they blend. Because the real power isn’t in the creator, it’s in the composition of the creator system.

Why Blending Tiers Beats Betting on One

Think of creators as different spirits in a cocktail:

Nano creators (<10K) bring raw authenticity. Their content isn’t polished, and that’s the point. They make your brand feel like a recommendation, not an ad.

Micro creators (10K–500K) add contextual proof. They have enough reach to matter but are still niche enough to align with customer identity.

Macro creators (500K+) create perceived legitimacy. They aren’t the goal, they’re the frame. Their job is to establish seriousness at a glance.

Individually, each serves a purpose. But mixed together with intent? They become a funnel-compatible flywheel.

How It Plays Out in Performance

Top of Funnel: Macro creators generate the first impression and stop the scroll. Even if the content underperforms in conversions, it creates mental availability that’s useful for retargeting.

Mid Funnel: Micro creators run testimonial-style UGC with richer storytelling. These pieces reduce acquisition costs by aligning products with use cases.

Bottom Funnel: Nano creators land the final nudge. Their super-specific niche often overlaps directly with buying intent. It’s not sexy, but it converts.

The full-stack approach consistently beats isolated bets, especially when paired with systematic amplification.

Strategic Layering, Not Random Partnerships

This isn’t about throwing money at 12 creators instead of one. It’s about assigning roles to each based on funnel stage, platform placement, and content format. That’s when you stop seeing creator content as “awareness” and start watching your ROAS climb, because you’ve turned creators into a modular media strategy.

Why it matters:

Performance marketers don’t need more influencers. They need better orchestration.

Because when your creator tiers are aligned by role, not just reach, you stop buying content and start buying outcomes.

🚨 Amazon Just Pulled Out of Google Shopping Ads, And It’s a Big Deal

Amazon has abruptly exited Google Shopping auctions across 20 global markets, halting a long-standing strategy that shaped retail CPCs and auction dynamics. This rare retreat stuns advertisers who relied on Amazon’s presence to benchmark competition and click economics.

The Breakdown:

1. A Major Player Is Suddenly Gone - Amazon has completely stopped participating in Google Shopping ad auctions, after a year of gradual pullback. Historically appearing in ~30% of Shopping impressions, Amazon’s absence is already noticeable; some advertisers report zero visibility even in free listings.

2. The Reasons Behind the Exit Are Still Murky - Experts speculate this move could stem from cost-cutting, AI strategy pivots, or even temporary seasonality like a Prime Day cooldown. Some believe Amazon may return ahead of back-to-school or Q4 ramp-ups.

3. For Everyone Else, It’s Game On - Amazon’s absence removes one of the most aggressive CPC escalators, potentially lowering auction pressure for everyone else. Brands now have a rare chance to dominate Google Shopping visibility, test new bid strategies, and increase impression share at a lower cost.

Amazon leaving Google Shopping isn’t just about ad spend; it shifts power. With one giant out of the race, smaller brands and DTC players can temporarily outpace competitors, experiment more affordably, and gain first-mover learnings. But this window may close quickly, so act now, before Amazon decides to re-enter the auction.

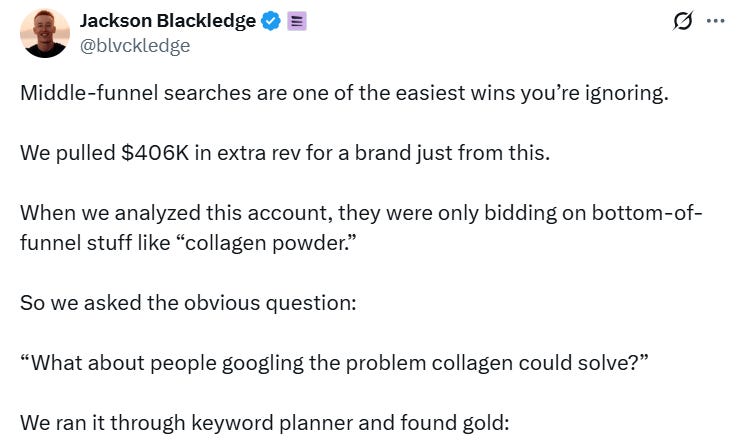

🗝️ Tweet of the Day

Advertise with Us

Wanna put out your message in front of over 50,000 best marketers and decision makers?

Checkout our Partner Kit here🤝

At Buyology, we care about our readers and want to provide the best possible experience. That's why we always look for ways to improve our content and connect with our audience. It would be amazing if you could hit us up with feedback about our content or absolutely anything, we are always up for a chat 🥰

Thanks for your support, We'll be back with more such content 🥳