The CAC Payback Triangle

🧠 Why Pros Inflate CAC on Purpose, and Meta shares AI Tips to Boost Ad Performance.

Howdy Readers 🥰

In this newsletter, you’ll find:

🧠 The CAC Payback Triangle

🚀 Meta’s AI Tips to Boost Ad Performance

If you’re new to Buyology, then a hearty welcome to you. You’ve reached the right place alongside 50k+ amazing people. Before you forget, if someone forwarded this newsletter to you, don't forget to subscribe to our newsletter so you never miss out!

🧠 The CAC Payback Triangle: Why Pros Inflate CAC on Purpose

DTC marketers are trained to fear rising CAC. But the best brands inflate CAC, intentionally, because they’ve built a machine that pays it back before the credit card statement hits.

Not in 90 days. Not with LTV guesses. But with precision-modeled retention loops designed to recover spend in 21–45 days flat.

That’s when CAC becomes leverage, not risk. And the only way to get there is by mastering the tension inside what we call the CAC Payback Triangle.

🔺 The CAC Payback Triangle

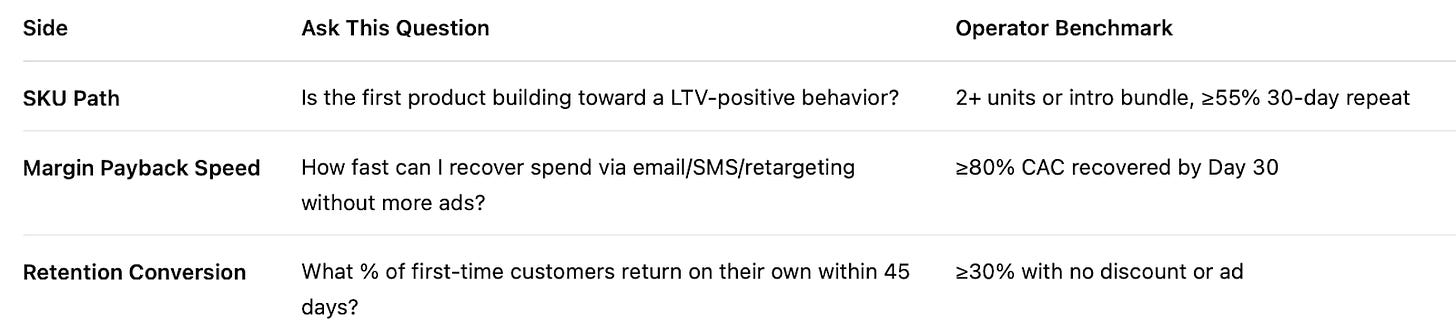

At scale, CAC isn’t just a number; it’s a balance between SKU Path, Margin Payback Speed, and Retention Conversion. Every dollar you spend must sit inside this triangle:

The more these variables push against each other, the tighter your CAC elasticity becomes.

💣 Where Most Brands Blow It

They treat CAC as static and LTV as eventual. But Good operators know the time between spend and recovery is the real enemy.

So they optimize CAC like this:

They push paid traffic to SKUs that unlock Day 15 reorder behavior, not just AOV wins

They trigger second orders via post-purchase flows, not remarketing

They measure recovery like this:

“If I spent $42 to acquire this customer, how much have I recouped by Day 21—and did it come from cash, not projections?”

And when they want outside traffic without upfront cost?

They use Levanta to pull in affiliate partners who convert and repeat faster than cold ads, with zero upfront burn. Levanta’s free Affiliate Shift Calculator can show you the exact upside hiding in your existing spend. With just a few inputs, you’ll see a custom forecast modeled on your numbers.

That’s not a side channel. That’s a CAC stabilizer.

🧠 The Hidden Upside: Cash Efficiency Multiplies When CAC Compresses

This isn’t just about media, it’s about liquidity.

When you recover CAC in 21–30 days, you unlock:

Faster inventory turns (buy less, more often)

Better payment term leverage (vendors love fast-flow cash)

Lower capital risk (less need for equity or credit float)

It’s the only kind of scale that actually self-funds. And it makes the difference between “marketing strategy” and operator-level financial warfare.

Final Reframe: The best CAC isn’t cheap, it’s short. If you can shrink your payback cycle, you can inflate your CAC and scale forever.

Together with Tatari

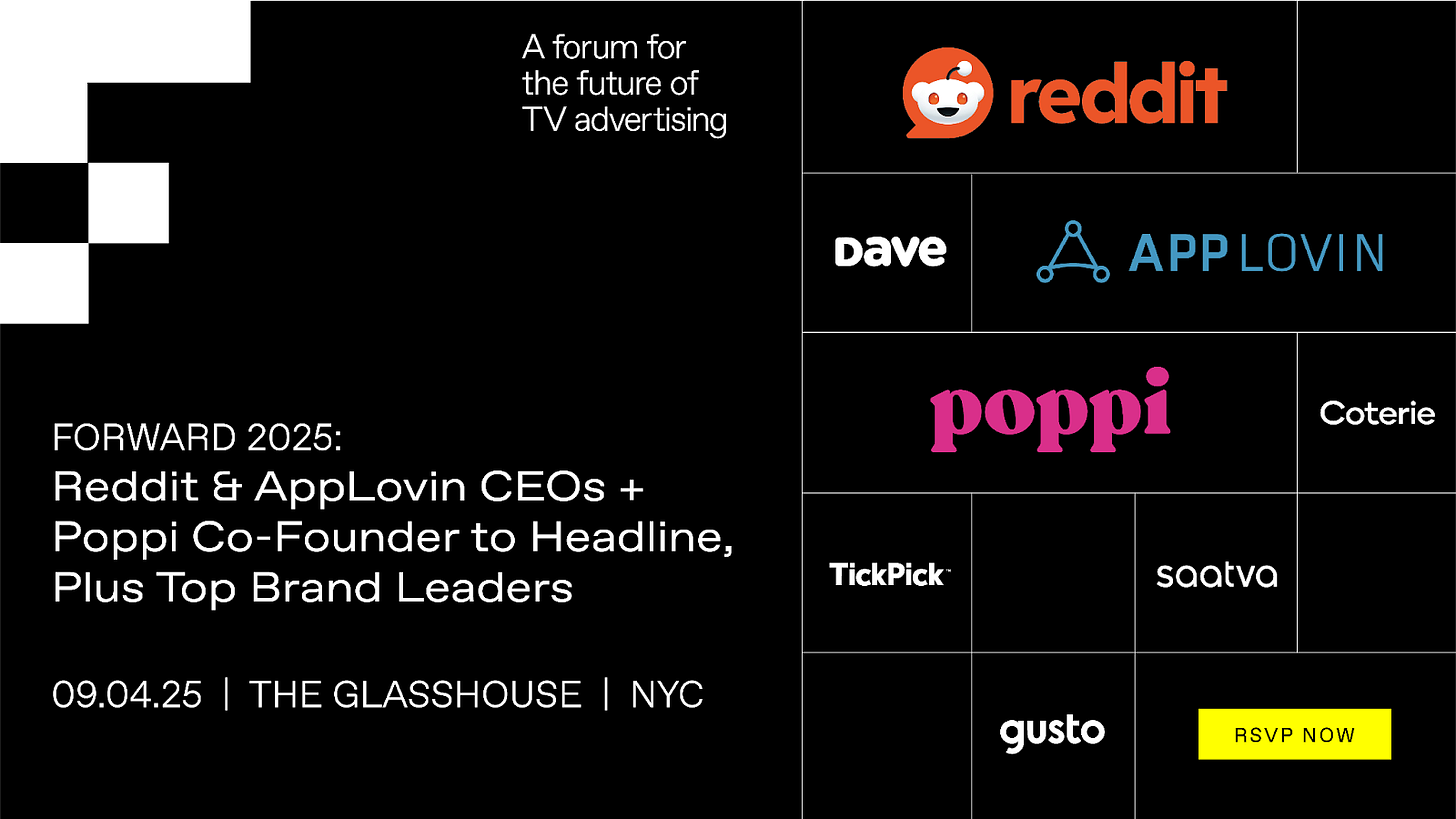

Forward 2025: Where Top CEOs and Brands Unveil the Future of Advertising (Sept 4)

Customer acquisition is shifting fast – paid social is harder to navigate, TikTok faces uncertainty, and Gen Z is skipping Google for creators and AI. Forward 2025 is where ambitious brands learn what's next.

On September 4th at The Glasshouse in NYC, join this free half-day conference focused on the future of advertising.

Hear from Steve Huffman (Reddit CEO), Adam Foroughi (AppLovin CEO), and Allison Ellsworth (poppi Co‑Founder & CBO) – visionaries shaping how brands grow today.

Plus, marketing leaders from Dave, Coterie, Saatva, TickPick, Ariat, and Gusto will share exclusive TV growth playbooks across three dynamic panels.

Cap off the day with a rooftop happy hour overlooking the Hudson, connecting with speakers and peers.

Forward by Tatari is built for ambitious brands to scale smarter in a shifting ad world, with TV as the next big growth channel.

Seats are limited. Reserve your spot and join industry leaders shaping the future of advertising.

🚀 Meta’s AI Tips to Boost Ad Performance

Meta has shared new guidance on how advertisers can maximize results using its latest AI-driven creative, targeting, and optimization tools. From automated video creation to smarter bidding systems, the updates show how brands can keep up with shifting behaviors across Facebook and Instagram.

The Breakdown:

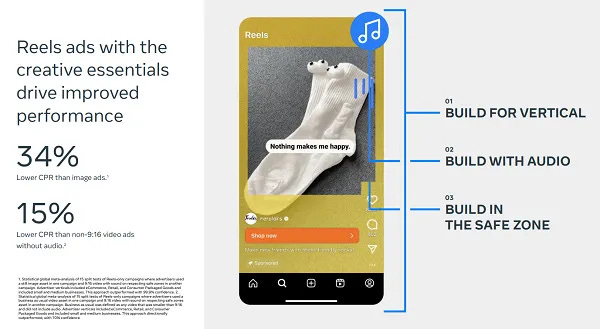

1. AI creative and video tools - Meta urges advertisers to upload multiple creatives so AI can test and optimize at scale. Nearly 2M advertisers now use its AI video/image tools, with brand results like Ben & Jerry’s seeing +7% clicks and -6.5% costs from AI-generated backgrounds.

2. Reels adoption and creator partnerships - Video watch time on Meta’s platforms is up 20% year-over-year, with Reels as the main driver. A survey showed that 79% of users have purchased after watching a Reel. Brands using creator-led Reels in campaigns reported 19% lower acquisition costs and a 71% brand lift on average.

3. Smarter targeting with Value Optimization - Meta introduced Value Rules and Value Optimization to give advertisers more control over audiences. Value Rules allow campaigns to prioritize different customer segments, while Value Optimization uses machine learning to predict potential ROAS for each viewer.

These updates show Meta doubling down on AI for creative generation, Reels for commerce growth, and smarter optimization for advertisers. Brands now have practical levers to stretch budgets further, expand video efforts, and ensure campaigns reach their highest-value customers.

Advertise with Us

Wanna put out your message in front of over 50,000 best marketers and decision makers?

Checkout our Partner Kit here🤝

At Buyology, we care about our readers and want to provide the best possible experience. That's why we always look for ways to improve our content and connect with our audience. It would be amazing if you could hit us up with feedback about our content or absolutely anything, we are always up for a chat 🥰

Thanks for your support, we'll be back with more such content 🥳