Beats the ROAS Every Time

🧐The SKU Strategy That Beats ROAS Every Time, Bing & Google Just Boosted Ad Controls, and more!

Howdy Readers 🥰

In this newsletter, you’ll find:

🧐The Margin-First Scaling Matrix: Why the smartest brands scale ad spend by profit, not just ROAS.

📊 Bigger Data & Better Controls for Marketers

🚀Tweet of the Day

If you’re new to Buyology then a hearty welcome to you, You’ve reached the right place alongside 50k+ amazing people, Before you forget, if someone forwarded this newsletter to you, don't forget to subscribe to our newsletter so you never miss out!

Together with Shipfusion

😰 Is Your Fulfillment Experience Chasing Customers Away?

Most DTC brands don't realize where they're losing repeat customers: after the sale.

To find out what great post-purchase CX actually looks like, Shipfusion placed orders with 30+ deodorant brands and dissected the entire experience.

The result? A detailed playbook for optimizing your fulfillment, CX, and retention strategy.

Inside, you'll learn:

👉 How referral inserts can boost customer acquisition by up to 20%

👉 How surprise freebies can raise repeat purchase likelihood by 27%

👉 How branded tracking pages keep customers engaged until delivery

It’s not just about deodorant. It’s about fixing the invisible friction that’s hurting LTV across every DTC category. Whether you're selling skincare, supplements, or pet care, this is the audit you can’t skip.

Download the report and turn post-purchase into your most profitable channel.

🧐The Margin-First Scaling Matrix: Why the smartest brands scale ad spend by profit, not just ROAS.

Most scaling decisions live and die by ROAS.

But ROAS can lie, it ignores returns, shipping costs, fulfillment complexity, and upsell velocity.

The real operators scale by Contribution Margin per SKU, making sure every incremental dollar in ad spend produces the highest net profit, not just revenue.

Why ROAS Isn’t Enough

Returns distortion: A SKU with a 4.5x ROAS can still lose money if it has a 30% return rate.

Fulfillment drag: Heavy, fragile, or multi-box SKUs inflate costs, eating margin.

Missed upsell lift: Some products generate disproportionate post-purchase revenue that ROAS doesn’t capture.

By weighting scaling decisions on profit per incremental order, you create a growth system that compounds cash flow instead of starving it.

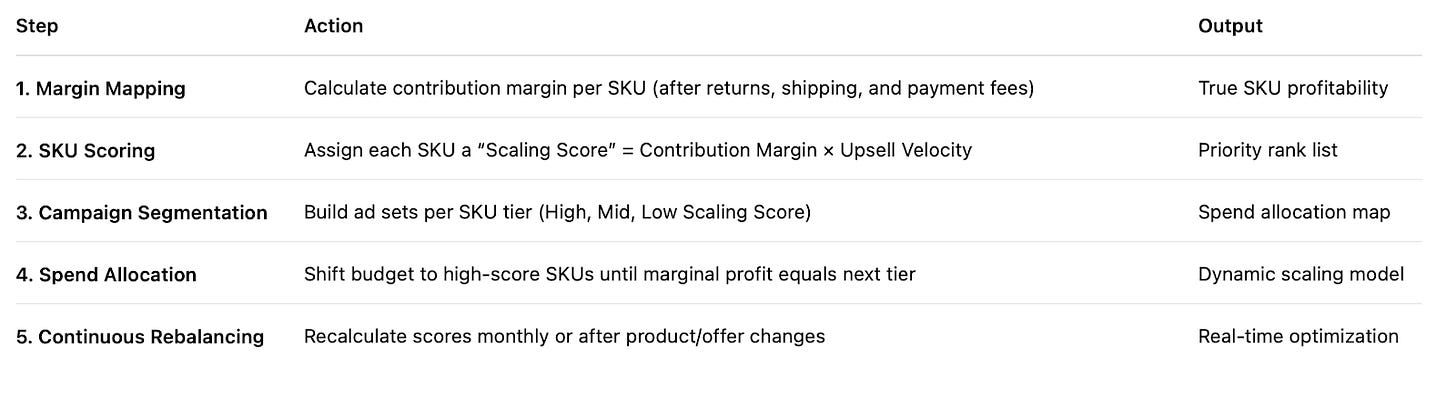

The Margin-First Scaling Matrix

Operator Playbook

Bundle High-Margin Anchors: Pair a strong-margin SKU with lower-margin but high-demand products to raise blended profit.

Avoid Scaling Loss-Leaders: If a product’s margin collapses at higher volume, keep it capped as an entry point.

Leverage Post-Purchase Upsells: Track margin impact from upsell take rates when deciding SKU scaling.

Mini Case Study

A mid-size home goods brand reallocated 40% of its TikTok budget from its highest-ROAS SKU to its highest-margin SKU (20% more margin per unit). Despite a 9% drop in ROAS, net monthly profit rose by $47,000 due to reduced returns and better upsell attach rates.

The Smart Amplifier

Once your high-margin SKUs are ranked, put your top-tier products into channels with rapid creative testing and precise audience reach. TikTok Ads is perfect for this, its algorithm can find high-intent buyers quickly, letting you scale profitable SKUs faster.

Right now, you can get $200 worth of TikTok ad credit when you spend $200, the perfect way to push your most profitable products into hypergrowth.

📊 Bigger Data & Better Controls for Marketers

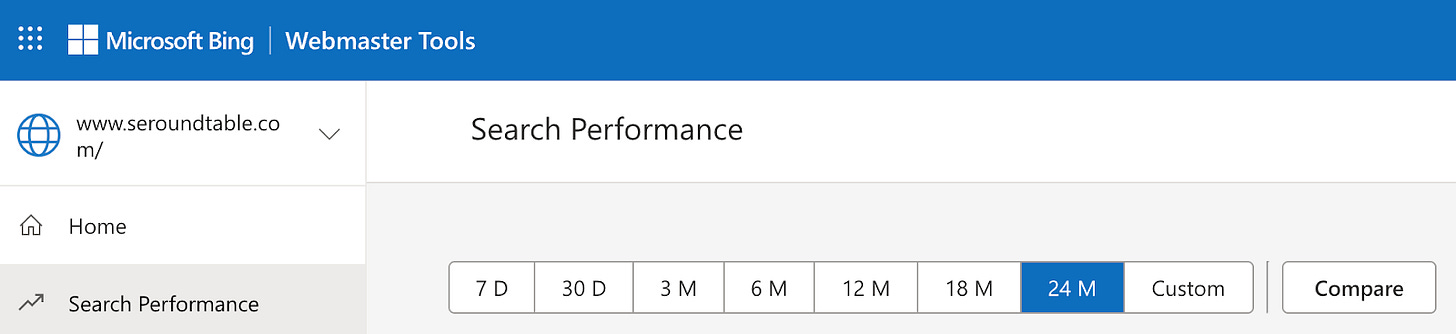

Bing and Google have both rolled out major updates giving marketers richer insights, more targeting precision, and greater creative control. Bing’s Webmaster Tools now offers a deeper historical view, while Google Ads is unlocking more of Performance Max’s “black box” with advanced targeting and transparency features.

The Breakdown:

1. Bing Webmaster Tools Upgrade - Bing’s Search Performance report now covers 24 months of data, up from 16 months last year. New country and device filters allow segmentation beyond keywords and pages, and keyword trendlines make tracking performance shifts easier.

2. Google Ads Performance Max Targeting Gains - Advertisers can now apply campaign-level negative keyword lists and double their search theme limit from 25 to 50 per asset group. Age exclusion targeting is live, a gender exclusion beta is rolling out, and full device targeting is available.

3. Creative & Reporting Improvements in PMax - Performance Max now shows asset-level performance across all campaigns, with visibility into assets from Final URL Expansion. AI-powered creative recommendations offer image edits and suggestions tailored to boost cross-channel results.

Bing’s expanded historical data and segmentation tools make SEO strategy sharper, while Google’s increased search theme capacity, targeting controls, and creative visibility give advertisers more levers to pull for ROI growth. These updates help teams act faster, optimize with precision, and compete more effectively in search and ads.

🗝️ Tweet of the Day

Advertise with Us

Wanna put out your message in front of over 50,000 best marketers and decision makers?

Checkout our Partner Kit here🤝

At Buyology, we care about our readers and want to provide the best possible experience. That's why we always look for ways to improve our content and connect with our audience. It would be amazing if you could hit us up with feedback about our content or absolutely anything, we are always up for a chat 🥰

Thanks for your support, We'll be back with more such content 🥳